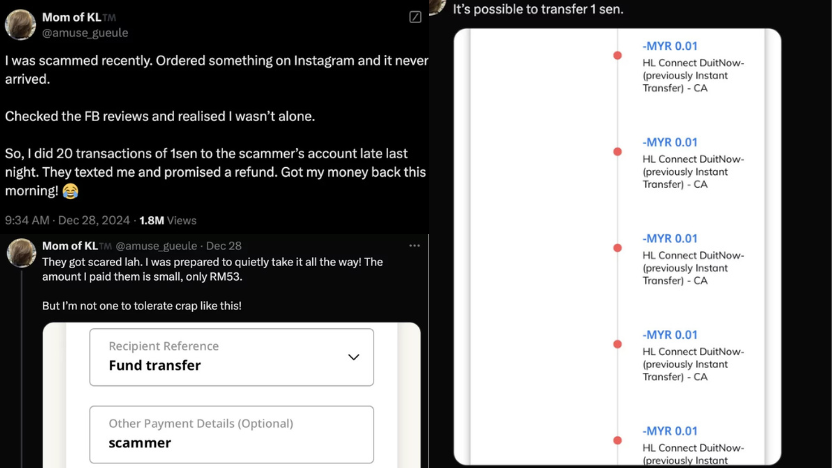

After about 20 small payments the seller suddenly messaged her and promised a refund, which arrived the next day.

How this likely worked is simple: banks and law-enforcement systems are tuned to spot unusual activity. Lots of tiny deposits into the same account, especially with an explicit note like “scammer,” stands out as suspicious behaviour. That pattern can flag the account for review, prompt the bank to contact the recipient, or at least push the issue higher up the bank’s monitoring queue and once the account is under scrutiny the scammer may decide it’s safer to return the money than risk having the account frozen or investigated.

It’s a clever tactic, but not foolproof. Scammers adapt quickly, and repeatedly sending money or messages could have unintended consequences, it might violate bank terms, slow down a formal investigation, or even complicate recovery if the transfers are treated as legitimate payments.

The safest steps remain reporting the transaction to your bank, lodging a police report, and using any platform dispute or buyer-protection options available.

Think of the one-cent trick as a creative last resort that sometimes nudges a resolution, not a guaranteed.

Source : The Rakyat Post

Image Credit : CTOS