The Housing Credit Guarantee Scheme (HCGS), managed by the Sistem Jaminan Kredit Perumahan (SJKP), plays a vital role in supporting the Malaysian Indian community, particularly those who face challenges in securing home loans due to irregular or non-traditional income sources.

Many self-employed individuals, gig workers, and those without fixed monthly salaries often struggle to meet the strict requirements set by financial institutions. Through this scheme, the government provides a credit guarantee to banks and lenders, enabling more people to access financing for their first homes.

For many families, owning a home is an important step toward achieving stability and improving their quality of life.

Supports Vulnerable Groups

Promotes Home Ownership

Improves Socio-Economic Status

Flexible Eligibility

Administered by SJKP

Credit Guarantee for Banks

First-Time Homebuyers Focus

The MIC has also announced plans to collaborate with community leaders and local branch heads to guide eligible applicants through the process and ensure they can access the benefits offered by the government. By assisting individuals’ step by step, the goal is to make sure no one is left behind due to a lack of awareness or guidance.

Originally launched in 2007 by the Housing Credit Guarantee Corporation, the scheme continues to evolve, adapting to current needs and expanding its support to more vulnerable groups. For many in the Indian community, it represents an opportunity to build long-term security, improve living conditions, and create a foundation for future generations.

Source : SJKP, nst

Many self-employed individuals, gig workers, and those without fixed monthly salaries often struggle to meet the strict requirements set by financial institutions. Through this scheme, the government provides a credit guarantee to banks and lenders, enabling more people to access financing for their first homes.

For many families, owning a home is an important step toward achieving stability and improving their quality of life.

Why the Scheme Matters?

Supports Vulnerable Groups

- Designed for individuals without fixed monthly salaries, including gig workers, small business owners, and the self-employed, who often struggle to secure financing.

Promotes Home Ownership

- By providing a credit guarantee to banks, the scheme gives lenders confidence to approve home loans for first-time buyers who might otherwise be rejected.

Improves Socio-Economic Status

- Home ownership creates long-term stability, enhances financial security, and uplifts families’ living standards within the Indian community.

Flexible Eligibility

- Tailored to accommodate applicants with *non-traditional income sources* and minimal collateral requirements.

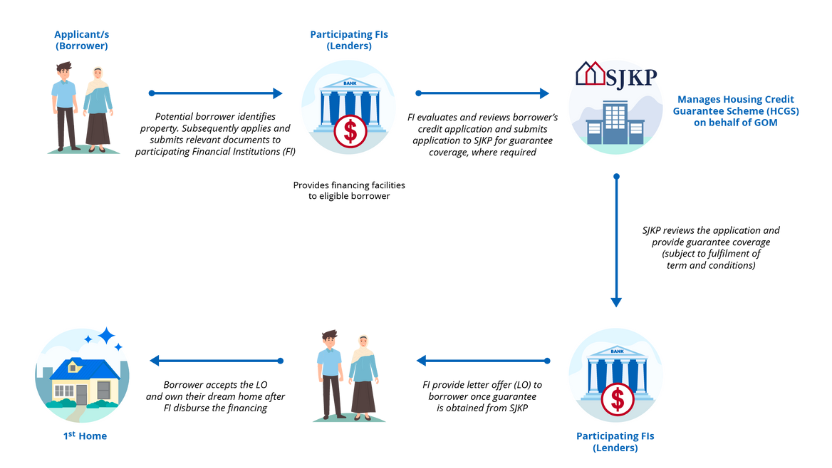

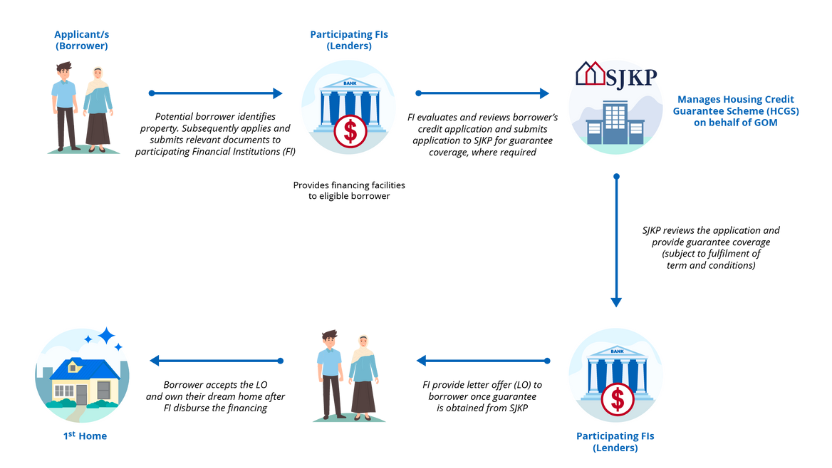

How the Scheme Works?

Administered by SJKP

- Managed through Sistem Jaminan Kredit Perumahan (SJKP), which oversees the application and approval processes.

Credit Guarantee for Banks

- If a borrower defaults, SJKP covers a portion of the loan amount, reducing risk for lenders and making banks more willing to approve applications.

First-Time Homebuyers Focus

- Specifically designed to help individuals buy their first home, ensuring they have better access to financing.

The MIC has also announced plans to collaborate with community leaders and local branch heads to guide eligible applicants through the process and ensure they can access the benefits offered by the government. By assisting individuals’ step by step, the goal is to make sure no one is left behind due to a lack of awareness or guidance.

Originally launched in 2007 by the Housing Credit Guarantee Corporation, the scheme continues to evolve, adapting to current needs and expanding its support to more vulnerable groups. For many in the Indian community, it represents an opportunity to build long-term security, improve living conditions, and create a foundation for future generations.

Source : SJKP, nst